The Future of Financial Consolidation with SAP S/4HANA Group Reporting

Why SAP S/4HANA Group Reporting is the Future of Financial Consolidation

Challenges in Traditional Financial Consolidation

Numerous organizations encounter obstacles such as dealing with data by hand, producing reports that consume too much time, and managing consolidation in a way that doesn't expose them to compliance risks.

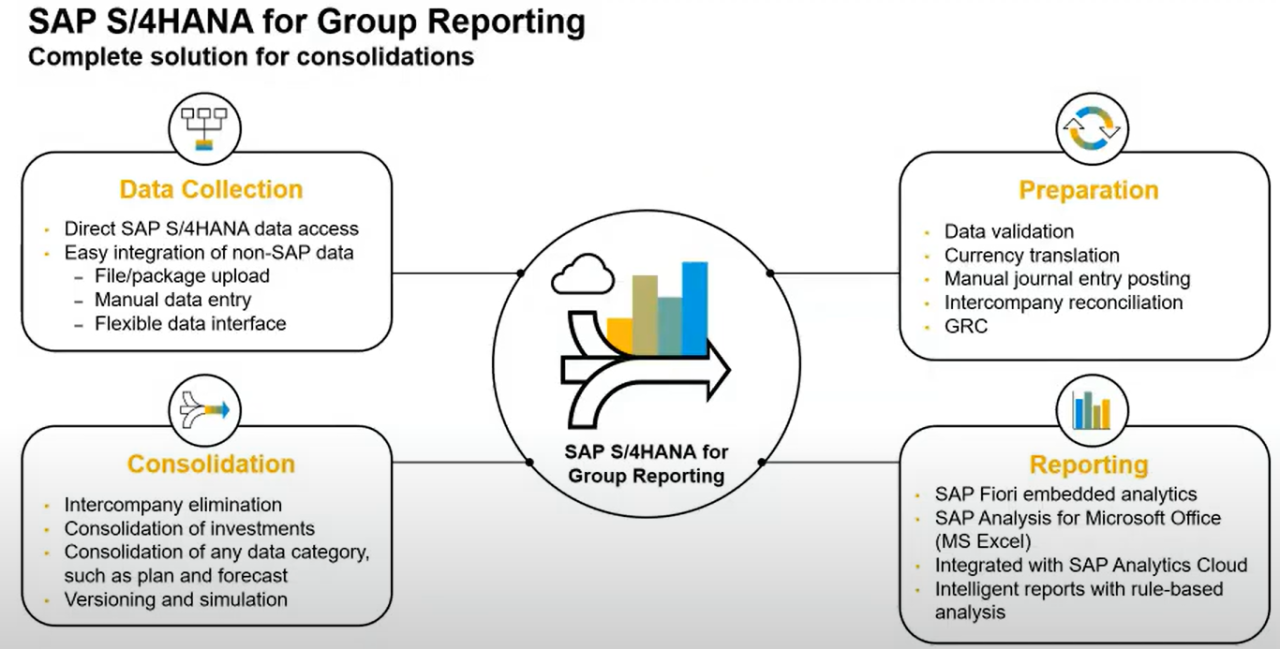

SAP S/4HANA Group Reporting: A Game-Changer for Finance Teams

A real-time, automated, and AI-enhanced financial reporting system eliminates old-time problems. That is what SAP S/4HANA delivers. It offers something in the neighborhood of 30 to 40 core financial reports, all produced automatically with no extra effort from the user (Aikens, 2021; Berg et al., 2018).

Key Benefits of SAP S/4HANA Group Reporting

Data Collection Done Automatically: Removes manual tasks and cuts down on errors. Conformance to World Standards: Guarantees compliance with IFRS and GAAP. Integration Across All Systems: Functions effortlessly with SAP and non-SAP systems.

How to Implement SAP S/4HANA for Maximum Efficiency

Best practices that organizations should follow include appropriate mapping of data, well-coordinated training for teams, and the use of sensible implementation strategies that take place in phases when called for.

Interactive Feature: Offer a downloadable PDF titled "Financial Health Checklist" that allows companies to evaluate their current consolidation practices.

Get In Touch With Us

Contact us for expert guidance.

Our Blogs

- Harnessing AI and Machine Learning for Financial Forecasting

- The Future of Financial Consolidation with SAP S/4HANA Group Reporting

- Exploring the Potential of SAP Datasphere in Modern Financial Management

- Difference between Launchpads and Dashboards

- Maximize Financial Insights with SAP Analytics Cloud

- Enhancing Financial Consolidation with S/4 Hana Group Reporting